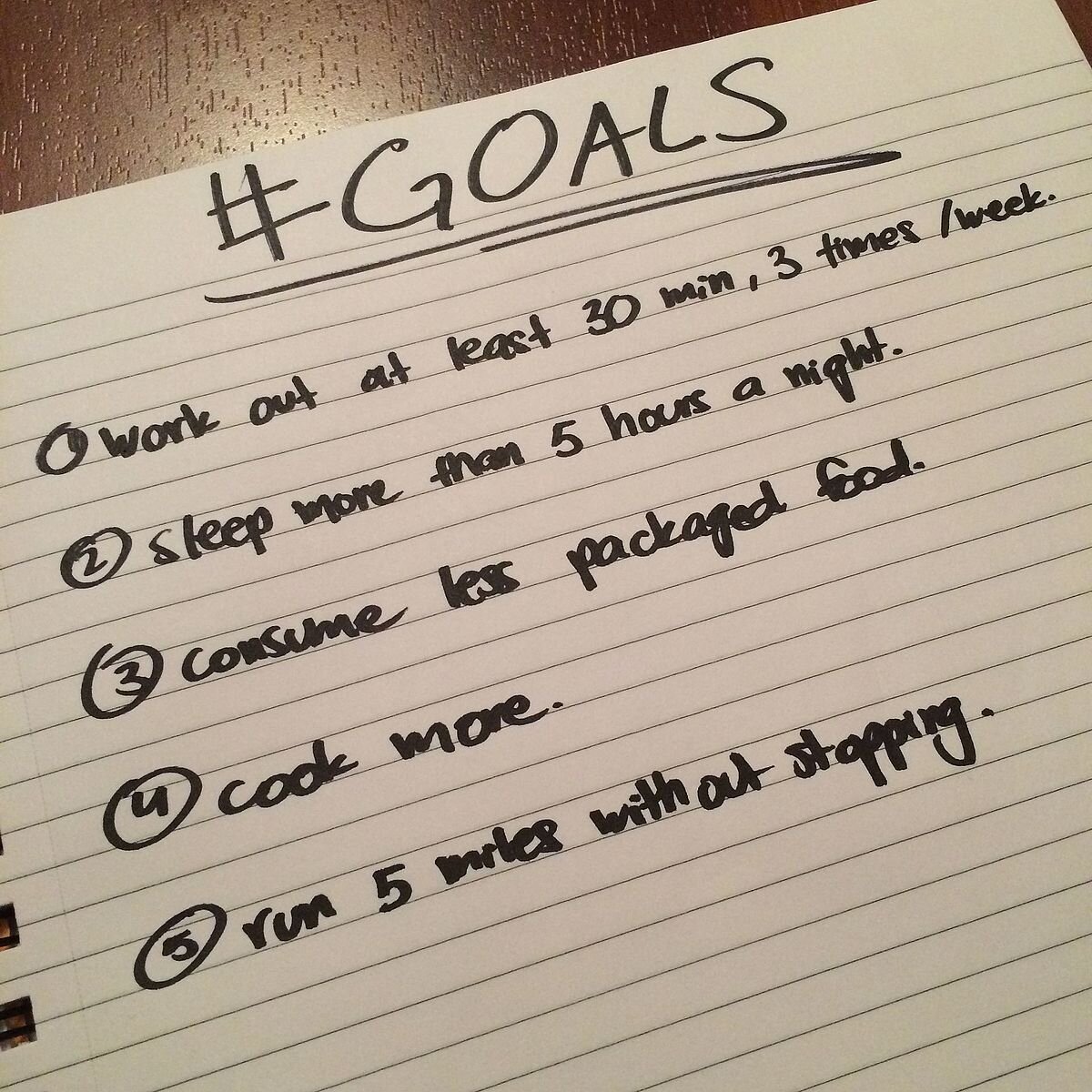

“Goals: I want everything!”

Prioritize family, career, running, personal growth (and the list goes on and on)

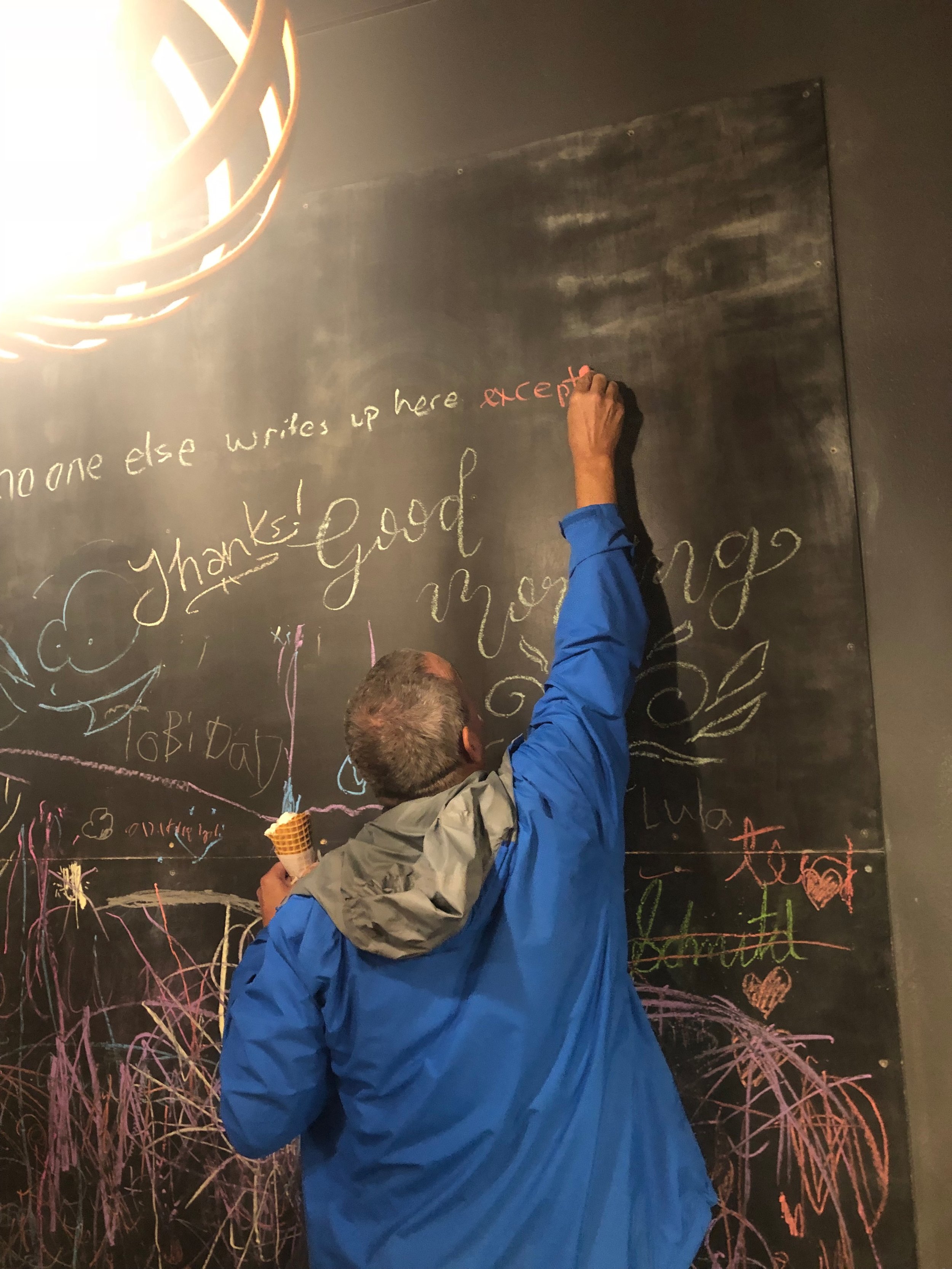

A few years back while on a roadtrip to Oregon for the scenic Oregon Coast 50K/25K my then girlfriend (now wife), Emily, asked what my highlights were for the past year and what I was looking forward to in the coming year. I responded and spoke my honest and irrational expectation, “I want everything!”

(Queue the dramatic music.)

I followed this with a list of fitness, life, relationship, work, financial and creative achievements from the previous year and goals for the coming one. This was less a prioritization of concrete objectives and more of an emotional outpouring of all of the things that were spinning in my head. From house projects to investing in our relationship to finances and advancing in my career—it was all my ‘most important thing’. However youthful it may sound, this spirit for making progress didn’t always stem from a positive motivation.

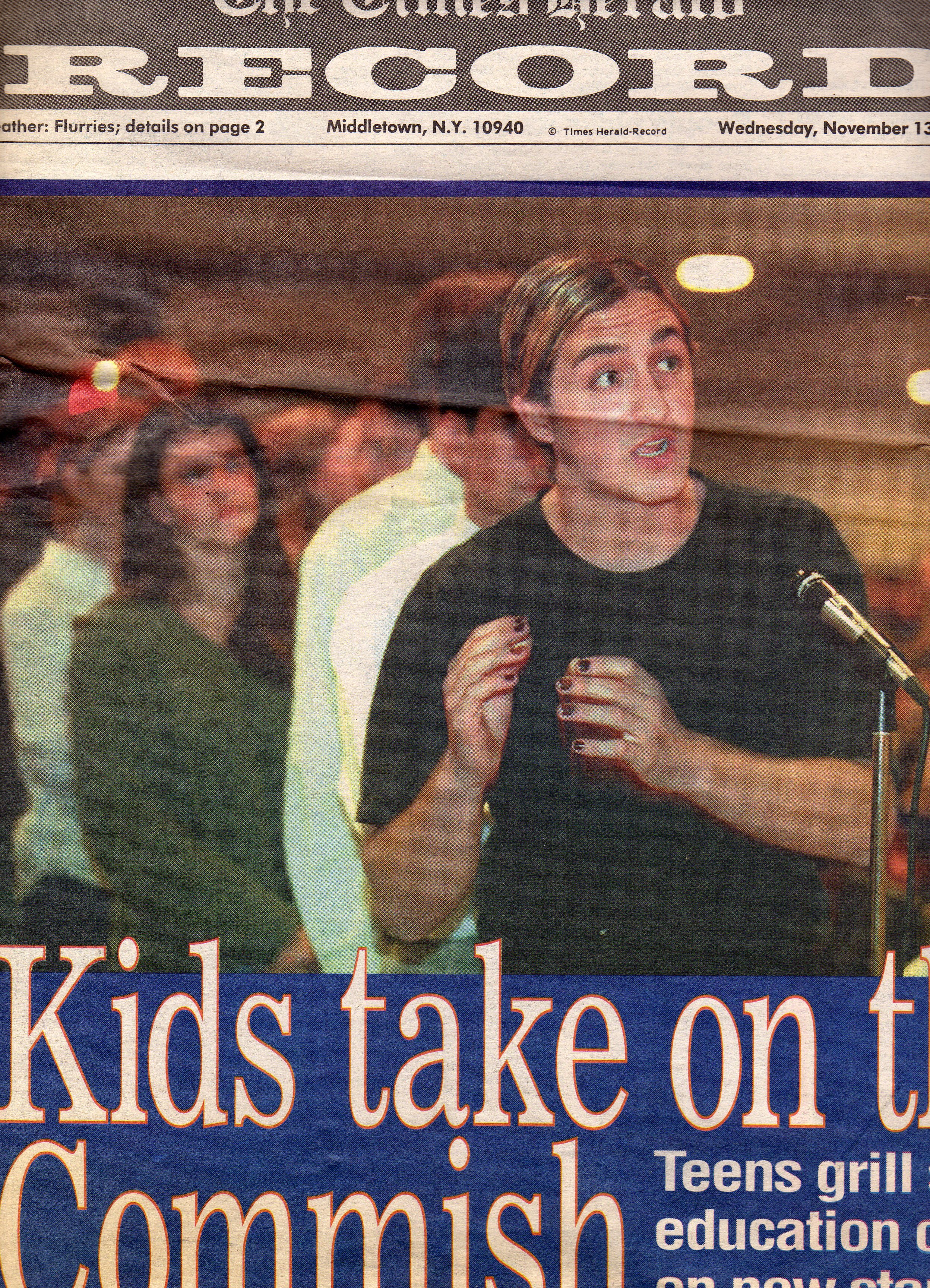

To an extend I’ve been haunted by a deep personal dread ever since I was a young teenager. My fear was that I was somehow far behind my peers in accomplishments, school and experiences, and that I desperately needed to catch up. Later in my early 20s that motivation manifested as a willingness to do as much as I could in every facet of my life. I decided to defer sleep and say yes to everything.

In reflection, the past year and a half was an expression of this desire more than ever before. How could I do it all? I desperately wanted to make significant progress on adulting. Luckily, my fortune was strong.

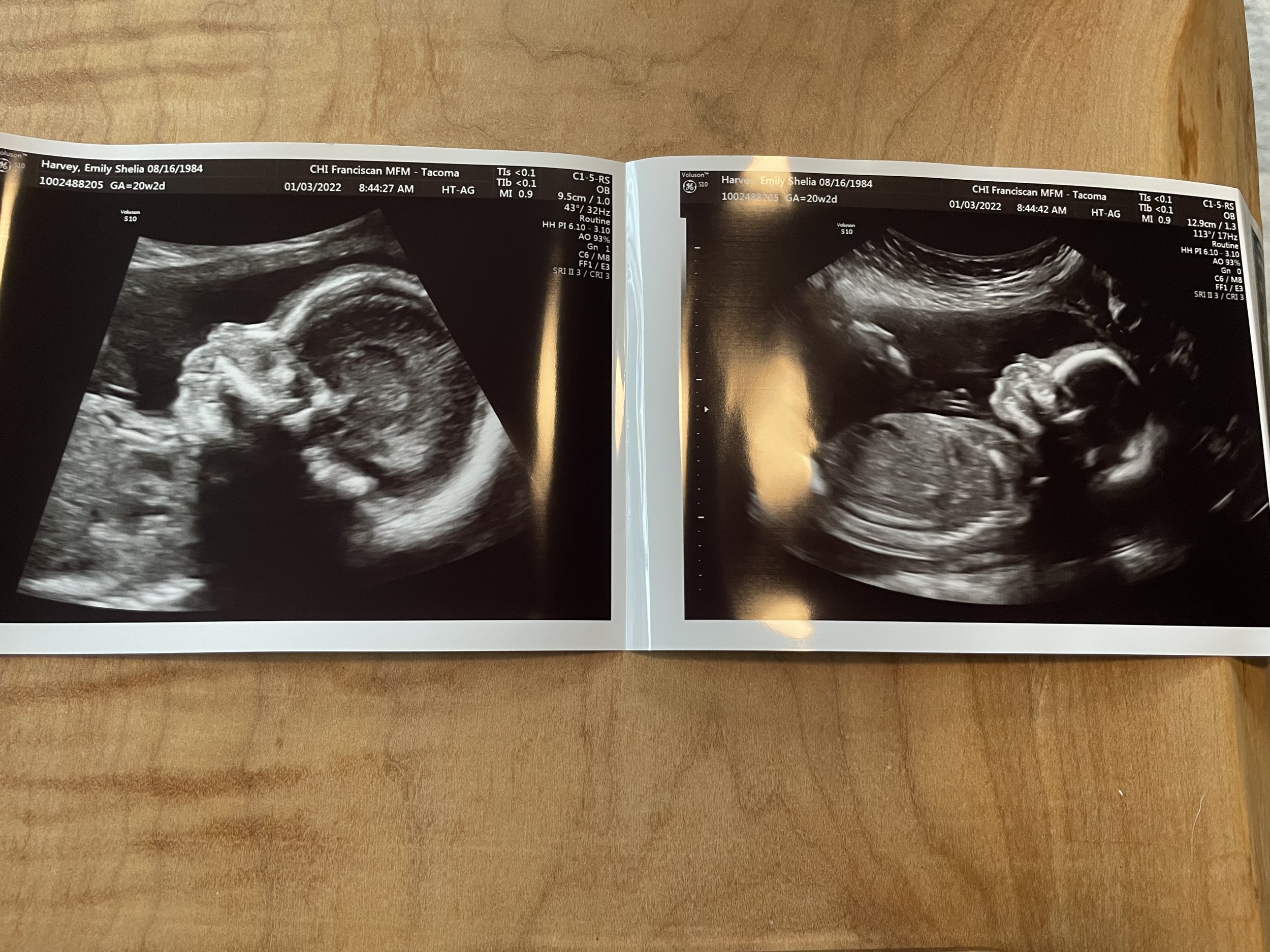

“BABY INCOMING!”

We took weekly photos charting Emily’s pregnancy and made it into a fun video here.

New Lifestyle

My wife and I entered 2022 focused squarely not on trail running, traveling or any other tantalizing t-words. Our focus was on our child who was due in May. Now known as Jack Richard, before his birth we didn’t know the baby’s sex and had limited experience with this phase of life as this was our first child. Every moment was new: buying a car seat, decorating a nursery, attending weekly “Your Badass Natural Birth” Zoom class and participating in increasingly frequent midwife appointments at St. Joseph’s Hospital in Tacoma. We balanced these duties with our work, and also continued to search for homes for sale as a new stepping stone from our first house on Trafton Street.

New Home

Now in January 2022, we knew the baby would be here soon enough plus the news reported whisperings that the Fed planned to raise prime interest rates from a historic near-zero. Because of this our house hunt took on an elevated pitch of intensity. Emily and I knew we needed to act now if we wanted that second bathroom and a little extra space to store baby stuff. After touring and having initial interest in a house that was recently flipped in Lakewood, we hired an inspector to offer his opinion. Unfortunately, the house showed numerous red flags so we immediately backed away from making an offer. In reflection this was a blessing, as was losing out on a #HeartBreakHouse in Central Tacoma two months prior. While we had toured over 40 homes over the past eight months, we knew we didn’t want to settle.

Maple (and Luna) approves of our new home.

The same evening we got the inspection report from the flip house my wife pondered, “What if we looked back at those new houses built across from Ft. Steilacoom Park?” We booked a second tour with Redfin that same night and drove out just as the light was fading from the sky. Immediately after touring the last of three new homes built next to a park we both deeply loved, we knew we had to make an offer. Our agent drafted the paperwork and within two days we were mutual with the builder. As luck had it we also negotiated a $10,000 concession from the seller so we could build a fence for our dogs, Luna and Maple. We knew come March we’d be decorating a new nursery for Jack and we wouldn’t have time to dig our own postholes.

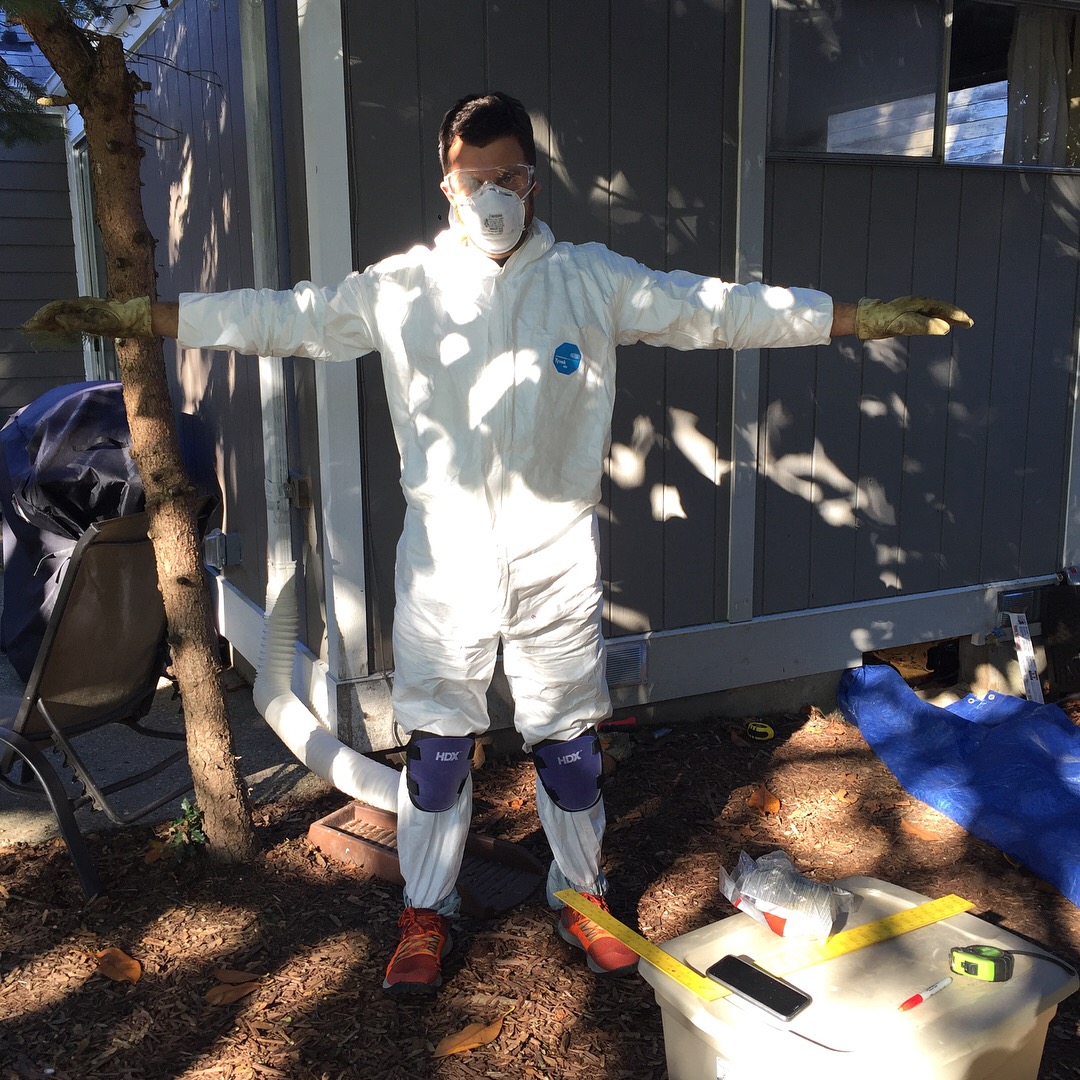

The next few months were a blur filled with doctors appointments, counting down the days towards our baby’s arrival, decorating our new home, fixing up our previous home (painted interior, furnishings, etc.), and renting it out to a traveling nurse couple from Tennessee. It was such a rush getting our former house ready that we couldn’t have the new tenants move in until 3pm as we were still placing the last of the decorations and had to finish mopping. Together with the other rental house we successfully operated in the Hilltop neighborhood and our new home we were still furnishing, there were a lot of balls in the air (or spinning moving boxes— you choose the analogy).

So, how exactly did we go from renters in our mid-30s to landlords and homeowners in just four years? Easy:

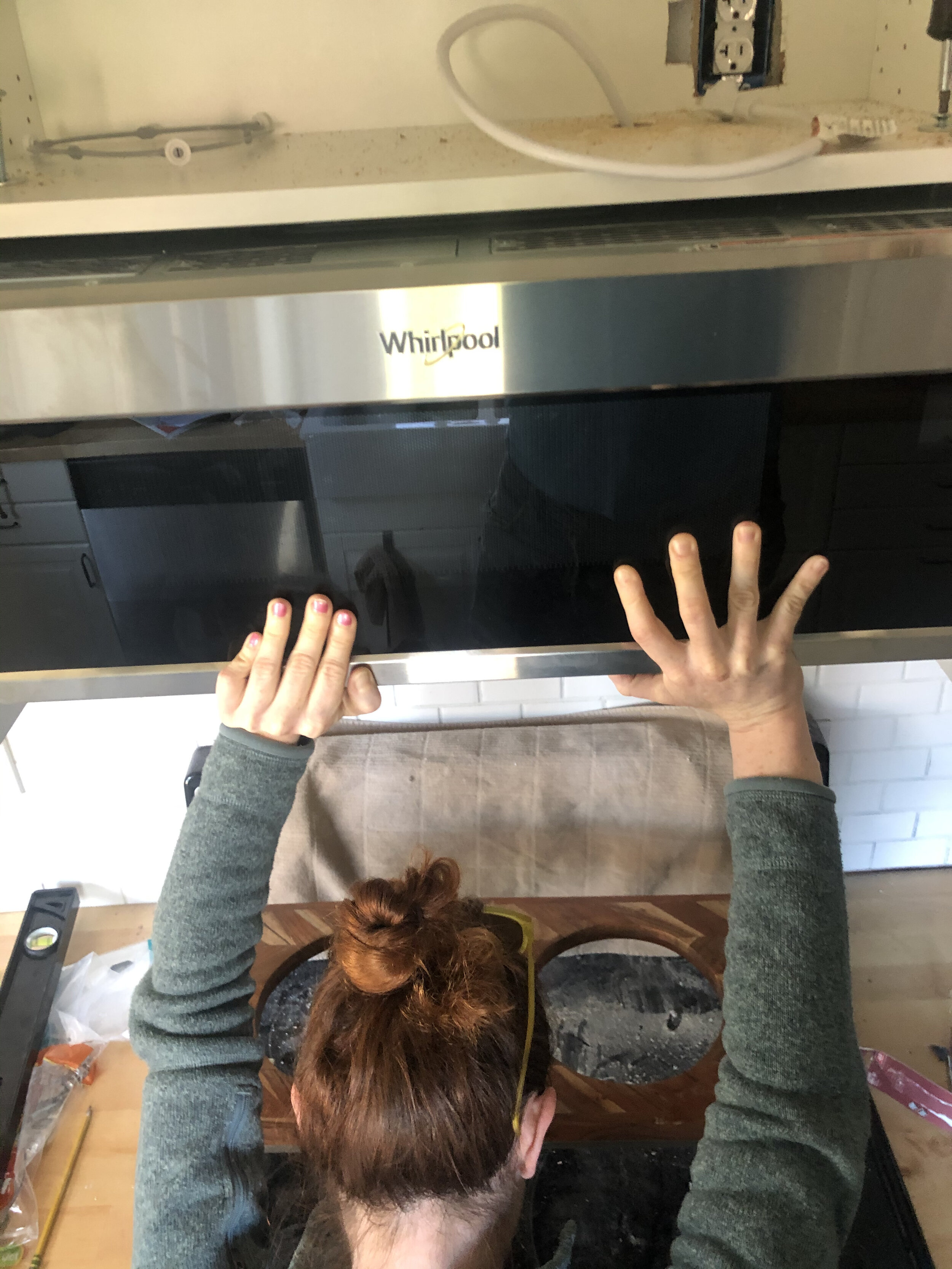

Our first house I bought with almost exactly $30,000 to cover a down payment and closing costs using a tax refund, returned rental deposit, annual bonus and savings. Thanks to an employee benefit from my work at BECU, I also benefited from a 1% rate discount off of an already historically low mortgage interest rate. Emily and I then spent the next three years improving the home originally constructed in 1948. This meant knocking down walls, installing new windows, new gutters, laying a new walkway and adding an electric car charger. For good order, we also redid the roof, added a hood microwave and repaired the chimney. Looking good!

Thanks to the improvements to the Trafton house and rising home values, we had sizable equity in the home despite living there for less than four years. We then did the financially risky move of taking out a HELOC on the house and using that along with savings to buy our current home—a new construction in Lakewood, while retaining the home and a rental home my wife owned. We then set a goal of paying off that $37,000 HELOC on Trafton within a year—which we achieved in February 2023. Despite the slowdown in the housing market and rising interest rates, we still made out alright. Yes, we paid a small amount of interest on the HELOC during the term we carried a balance, but luckily that was dwarfed by the increasing value of each property, and potential future cash-flow opportunities from the two rentals. (Dave Ramsey, please don’t hate me.)

So far we’ve had 100% occupancy for the two rental homes and earn enough in monthly income to pay the mortgage, utilities and lawn maintenance, plus make capital investments including new gutters, new Trex decking, a heat pump and new carpet. The goal is to continue to invest in each property so that when we do choose to sell we will get a solid valuation.

For house projects, we built a fence for the dogs, added a french drain to reduce moisture in the backyard and installed a 6.5KW solar array on my roof.

Now back to planning for baby…

Soon enough Emily, the dogs and I were settled into our new home and new routine. Located in Lakewood, the new house boasts four bedrooms and 2.5 baths and sits immediately next to the giant and lovely, Ft. Steilacoom Park. Daily we took walks with our dogs Luna and Maple on the trails weaving between scrub oak trees and play fields. During the summer we visited the Tuesday afternoon farmers market, and just enjoyed the peace and quiet of our new home. This was a big environmental change for us after living in Central Tacoma where cars raced down our street, drug sales were made at the end of our block, and where we heard frequent gunshots break the silence of the night.

New Baby

Emily’s due date was Friday, May 20,022. However the day came and went without belly gyrations or baby cries. Same with Saturday and Sunday. That night when we tucked into bed Emily and I wondered, “Will I be working tomorrow?”

The night set our destiny.

Early the next morning Emily started feeling contractions and by 5AM the news was clear: She was in LABOR! The next 72 hours were a blur full of contractions, pushing, pain and eventually a c-section. But the best and only thing that mattered was that it resulted in a healthy mommy and healthy baby. Hurrah!

Meet Baby Jack Richard

While my mother or father never asked as much, I wanted this day to come so much not just for myself and my wife, but also for my parents. And more specifically, it was important to realize my child’s birth before my father passed. You see for the past five years he battled stage four lung cancer, and while his efforts have been noble, I knew he would not be able to fight for forever. Just over a month after Jack was born my parents were able to travel west and meet their third grandchild, yet another healthy and rambunctious baby boy.

New Work Projects

While I recently experienced the birth of my first child after nine months of anticipation, that wasn’t even that long to wait compared to other efforts I was eager to see through. For almost a year and a half I’ve been working with my colleagues at BECU to develop, produce and launch our next brand marketing campaign. You see after the COVID-19 pandemic broke out, we paused the development of new advertising, both to assess the changing economic conditions, but also because hosting a photo or video shoot with real people was next to impossible with social distancing and lockdowns. As a gap effort, we reintroduced our More Than Just Money messaging and used still images that we developed into motion graphics to help sustain our marketing efforts during this transitional period. This worked as a bridge while we assessed the situation. Once we knew that the world wouldn’t be collapsing, and that we’d eventually return to normal creative productions I worked with my VP Stephen and our marketing leadership to conduct primary research and developed a new marketing campaign concept. This ultimately took the form of Power in People, a new brand anthem for one of the largest community credit unions in the U.S., BECU.

We launched with three new ads telling the story of three unique and real BECU members. We followed this up with an anthem ad later in the year, and in the new year launched product-focused :15 and :30-second videos highlighting business banking, credit cards, free checking and personal loans. Most recently I produced an ad telling the story of our BECU Early Saver account featuring the very cute Sarai and her family.

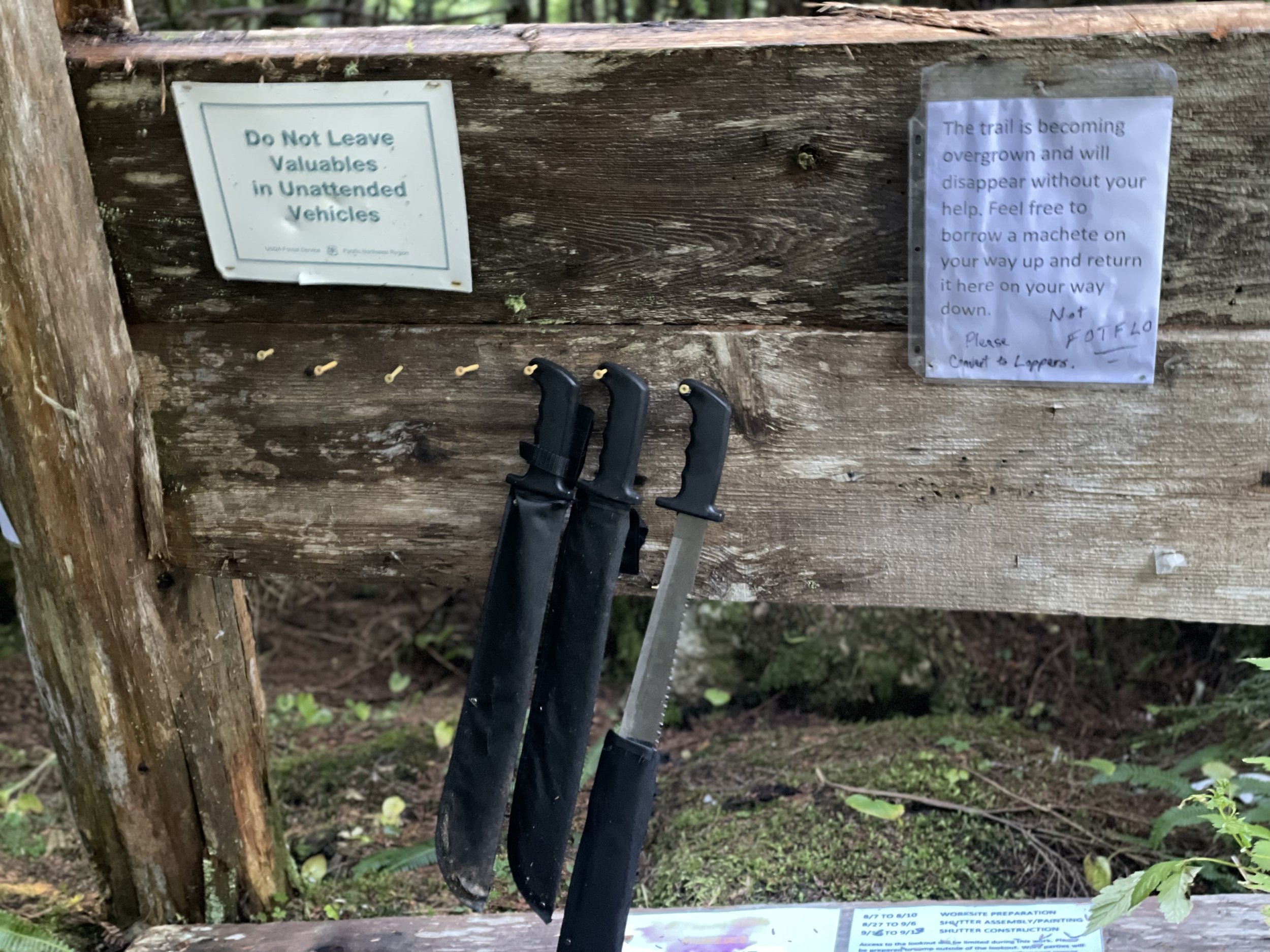

New Mountain Adventures

Somehow along the way, and due in no small part to the kindness and support of my wife, I was able to go on at least a few outdoor adventures. I climbed Adams after driving to the trailhead after work, sleeping in my car and starting out in the early morning. It was a very straight forward climb with rolling false summits of powdery snow followed by one final climb to the summit. The bonus was ample glissading down to the parking lot. The only downside is I dropped my Badwater 135 water bottles along the way. Boo!

In the Fall I was able to take vengeance on Three Fingers Lookout—a climb I had to turn back on last year after running short on time. The 34-mile out and back includes countless dramatic moments including 18-miles of gravel biking, spirited hiking, ladder climbing and a final sketchy ascent.

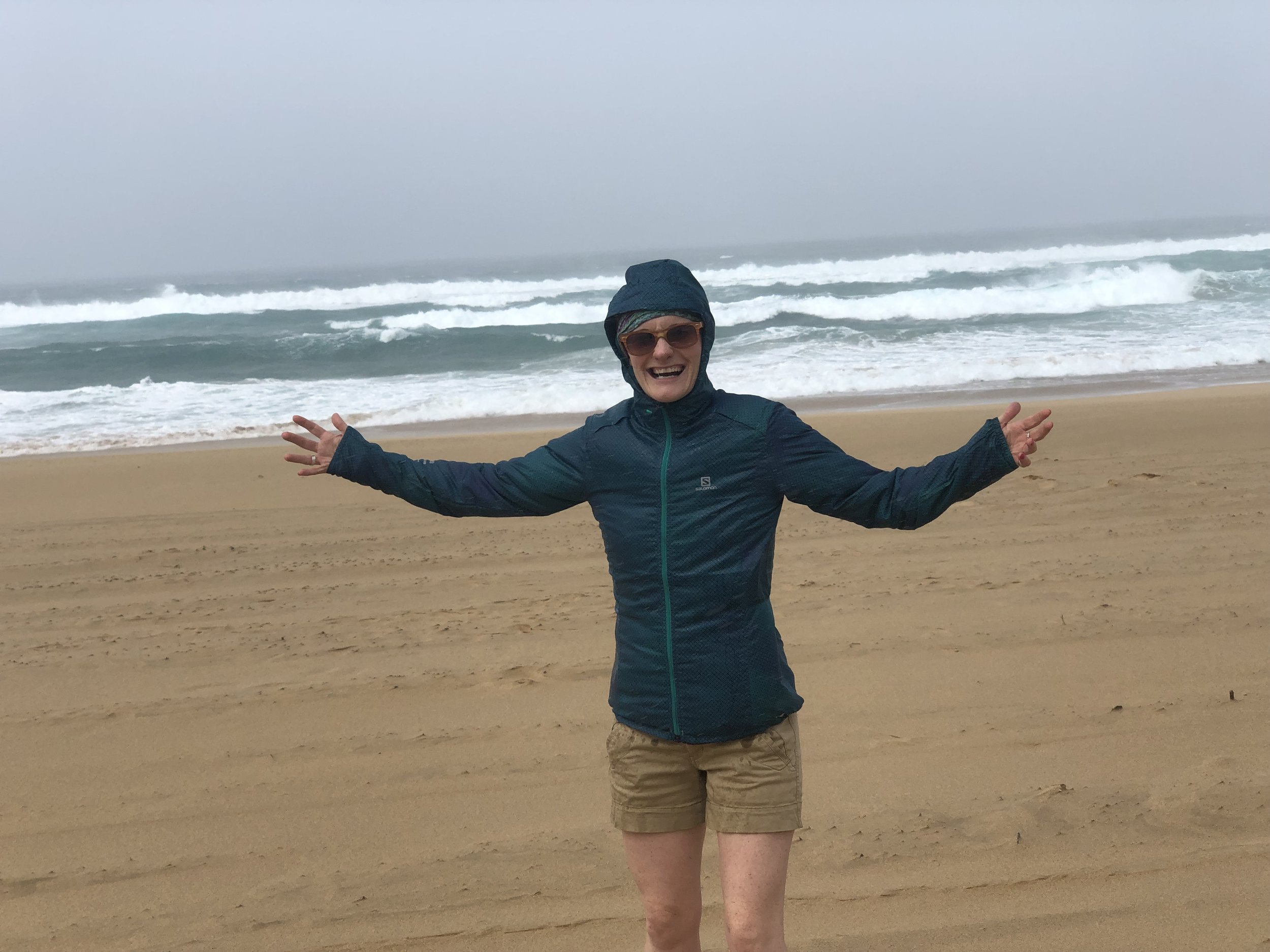

And the adventures weren’t always solo either. Emily and I did our best to get Jack and our dogs used to traveling. We took trips to the WA and Oregon Coast, including glamping and day trips to the beach. While we have yet to perfect the art of a restful night with two dogs and a new baby, we will keep trying. :)

New Plane

Now if life doesn’t sound intense enough, get a load of this. We did much of this while Emily was on maternity leave, all the while knowing that when she did go back in December that she would likely start the process of being certified on a new airplane. This meant lots of studying, classroom instruction, time in the simulator and then actual flying. Plus, much of the training wasn’t in Seattle, but rather at the Portland training headquarters of Horizon. This meant Emily, plus dogs, baby and husband would be traveling for weeks at a time to Portland and back home over and over. Somehow we did it. Thanks to Airbnbs in Vancouver, Washington, and WA state’s parental leave policy we were able to time my three-months-off for Jack’s birth perfectly with when Emily had to go to training. Somehow we made it.

By April Emily was done her simulator training and in May she got her checkride over the course of several multi-day trips. She didn’t want to be away from Jack, myself and the dogs, but now was the time to get through this (almost) last step. By the end of May, Emily was done and now was certified as a captain on the Embraer 175—a fancy, smancy jet.

While Emily (and everyone) made it, we were all exhausted. While I’ve run lots of trail races, the period of Spring 2022 to Spring 2023 took some of the greatest amount of endurance that I can ever recall. It was an ultra-ultra. But the finish wasn’t here yet.

New Chapter

We had one other change that I’ll be going into greater detail in another blog post, but I would be remiss if I did not mention it here. My father Rich’s health took a turn for the worst in April, just as Emily was finishing the last section of her simulator training in St. Louis. After six and a half years of battling lung cancer he passed away at my family’s home in New Windsor, NY. Luckily, Jack, Emily and I along with my mom and brother’s family were able to visit with him before his passing. My Dad Rich was my hero. He is my hero. He will be missed.

What’s Next?

It had been one heck of a 24-month sprint from implanting an IVF embryo to house shopping to giving birth, maternity leave and training up on a new plane. Emily and I were grateful for all the wonderful, scary and hard things that came our way.

I may be tired, but I don’t want to slow down. There is too much to be done.